Technical

Steel still the cost effective choice

Structural steel framing solutions have again been confirmed as faster and cheaper to build than reinforced concrete alternatives in the latest update of a cost comparison study that dates back to 1993. Nick Barrett reports.

A team including Davis Langdon, Arup and MACE conducted the study, commissioned by Corus. Its results help explain why steel framing solutions continue to dominate as the first choice for multi storey buildings and other structures, as confirmed by a market share survey.

The cost comparison study considers two typical modern commercial developments, Building A which is a 2,600m² office in Manchester, and Building B, which represents an eight-storey prestige office building of 18,000m² in London. A range of steel, composite and concrete based frame solutions for both buildings were fully designed, costed and programmed (see table below).

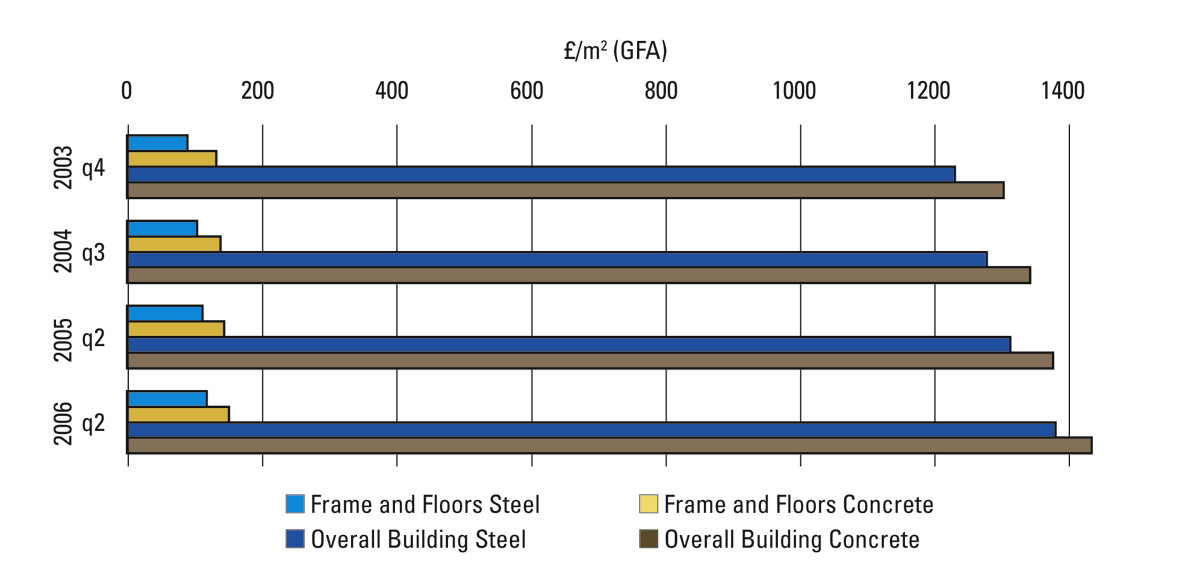

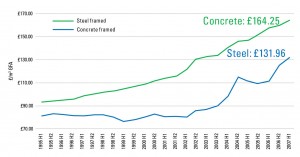

Graph A (Comparison of steel and concrete frames and floor costs Buildings A and B – average of all schemes, over page) shows that steel is the cheaper option, as it has been for many years. The conclusions hold good for other building types in sectors like healthcare, education and retail.

Graph A tracks the average cost per m² for the steel and the concrete frame and floor options. The figures are derived from the cost study conducted by Davis Langdon and are tracked using Department for Business, Enterprise and Regulatory Reform (BERR – formerly Department of Trade and Industry) cost indices.

Graph A: Comparison of steel and concrete frame and floor costs

Buildings A & B , average of all schemes

At June 2007 prices the concrete frame and floor options cost an average of £164.25 per m², as Graph A illustrates. This is £32.29 more than the average steel cost of £131.96 per m². So the cost differential between the average steel and concrete options is actually wider today than in 1995 when the steel options were £14.03 cheaper.

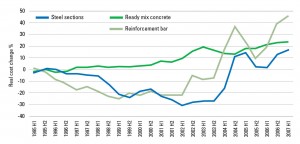

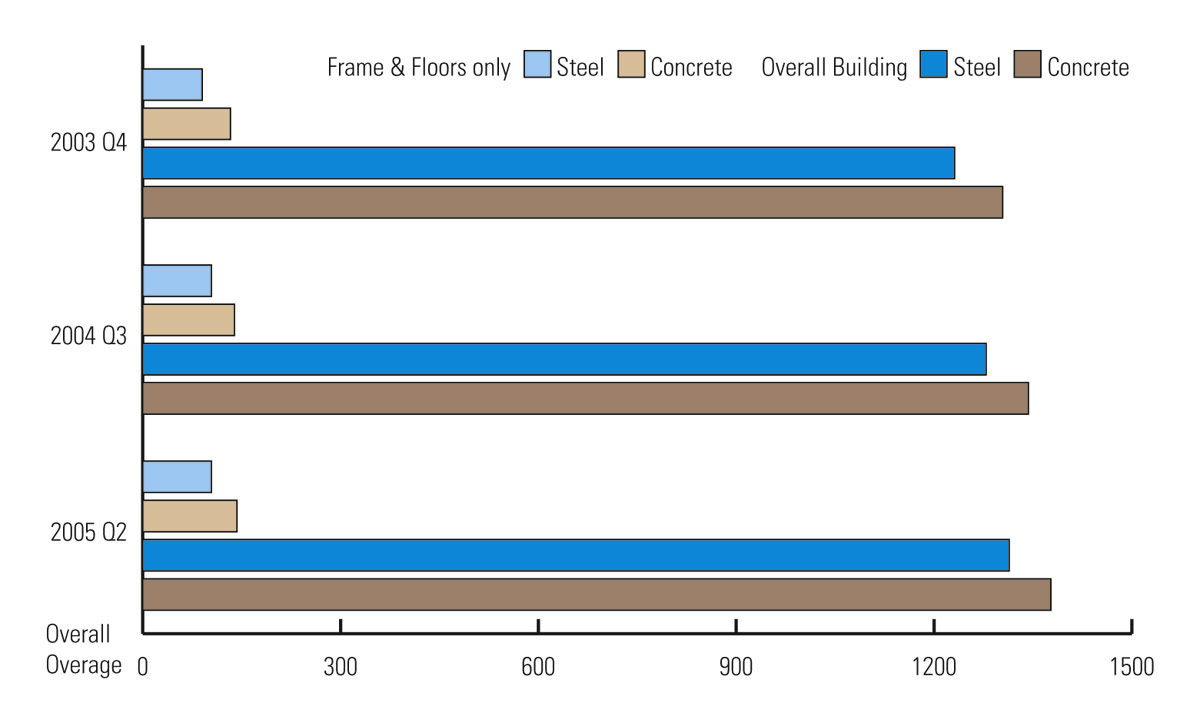

BERR produces monthly statistics tracking material costs against GDP inflation to provide a comparison in real terms (see Graph B: Raw material costs relative to inflation and Graph C: Constructed component costs relative to inflation). Graph B shows that in comparison with 1995, the cost of steel has increased by 17%, but the cost of concrete has increased by 24% while reinforcement bar has increased by 46%

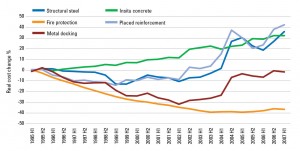

Comparing the constructed component costs of the alternative framing solutions over the same period, Graph C, BERR statistics show that the relative costs of the key steel framed building components fire protection and metal decking, have fallen when compared to ready mix concrete and reinforcement bar, which are key components of concrete frames. This has helped ensure that the relative competitive position of concrete and steel frames remains unchanged.

‘These official statistics help explain why the strong competitive position that steel long ago established over concrete remains unchanged,’ said Corus General Manager Alan Todd. ’The cost of a frame and floor is a relatively small part of the total cost of a development. However, the selection of a steel frame reduces timescales and has a beneficial effect on other major variable cost items such as foundations, cladding and services, leading to significant cost savings for the overall project.

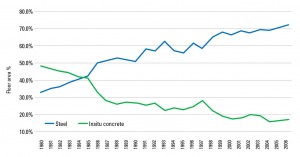

‘Designers and contractors appreciate the cost and other benefits of steel, of which a strong sustainability case is increasingly important, and this explains why steel frames enjoy a market share of 73% for multi storey frames and dominate the single storey market with a share of over 90%.’

Construction market prefers steel

Cost effectiveness is one of the many advantages of structural steelwork. This position is reflected in another long established independent industry-standard survey, which has measured the relative market share of structural frames annually since 1980.

The most recent results, see Graph D: Market share for steel and concrete frames UK Multi storey buildings, show that steel is preferred as a framing solution for over 73% of multi-storey commercial buildings, while insitu concrete accounts for 18%. The remaining 9% of the market is attributed to load bearing masonry, pre-cast concrete and timber.

Mr Todd concluded: ’This strong performance in driving down costs in real terms over so many years is testament to the commitment of the entire constructional steelwork sector to first of all improving its own productivity and then sharing these benefits with customers.

‘Steel designers have the widest possible range of in depth technical back up from the steel sector to ensure that their task is as straightforward as can be. Corus and all of its partners in the steel sector are dedicated to ensuring that this support continues and is developed further.’

For further detail please visit: www.corusconstruction.com/coststudy